venmo tax reporting for personal use

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. You should get a 1099-NEC for 800 from Client A and a 1099-K reporting the 700 from Venmo.

Venmo Tax Reporting For Personal Use Does Venmo Report To Irs

The American Rescue Plan Act only broadens the reporting needed to collect tax information once a taxpayer nears or reaches 600 in goods and services transactions.

. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. Personal transfers wont be taxed. Open separate P2P accounts for business and personal use to make reporting.

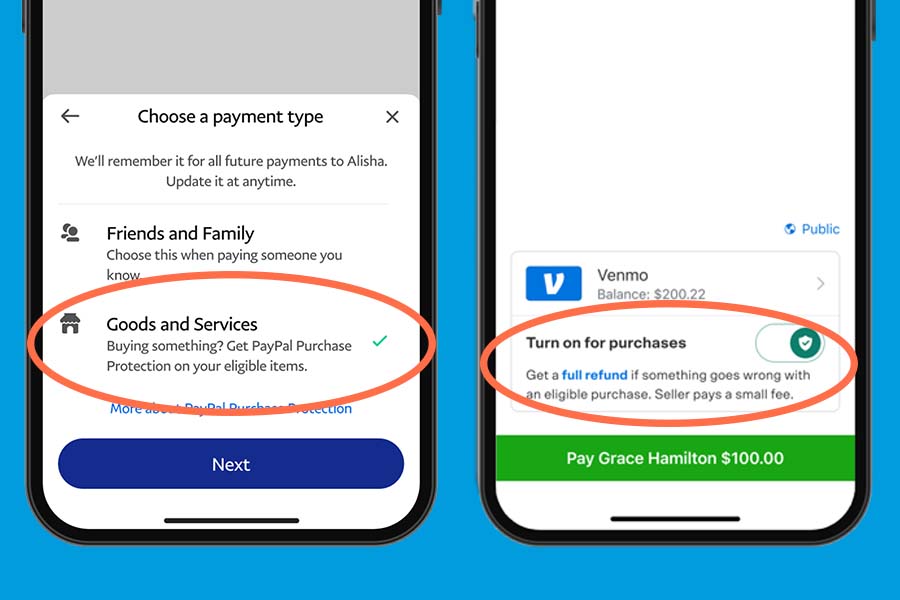

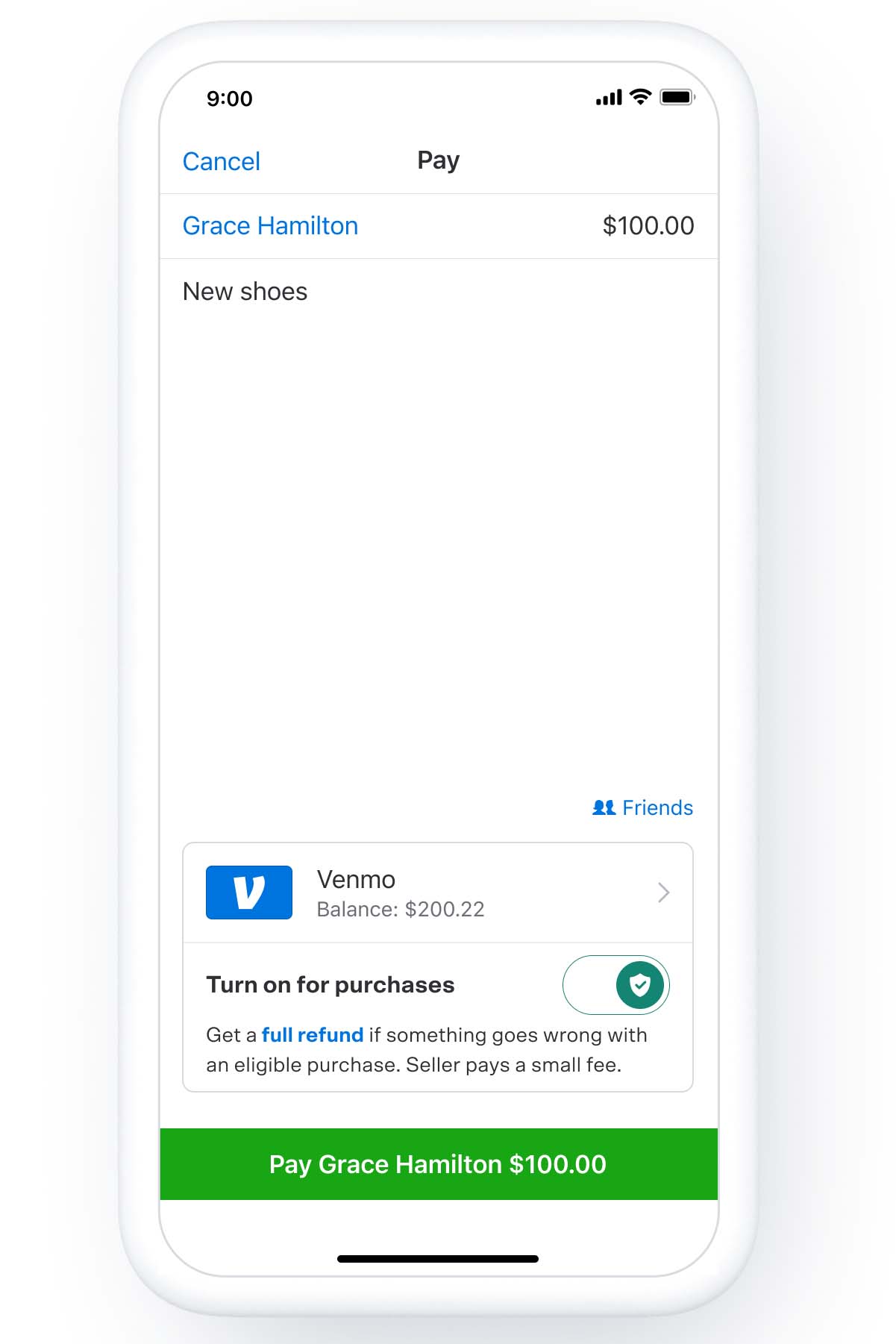

This feature is offered in our sole discretion and may not be available to all users. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year. You may need to take steps now to ensure compliance such as updating your tax information including a Social Security Number or Tax ID to continue to accept payments for sales of.

While the new IRS income-reporting requirements sparked backlash online those who use third-party payment apps for personal transactions like splitting a restaurant bill among friends will not be impacted by the new income-reporting requirements. While this threshold is significantly. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year.

The new reporting requirement however wont necessarily deter tax evaders and it may cause problems for casual users of these platforms. We may also offer you the ability to set up a business profile within your personal Venmo account which you can use to receive payments for the sale of goods and services. The IRS wants to make sure it is seeing all income on tax returns of part-time resellers and business owners.

Its probably because youre a resident of Maryland Massachussettes Mississippi Vermont. Lets say you receive 12000 in goods and services transactions on Venmo and 5000 on PayPal. The previous threshold was 20000 and 200 transactions.

The American Rescue Plan Act only broadens the reporting needed to collect tax information once a taxpayer nears or reaches 600 in goods and services transactions. Here are a few tips to keep in mind for a smoother transition. The IRS wants to make sure it is seeing all income on tax returns of part-time resellers and business owners.

Those who use cash apps to avoid traditional forms of income reporting will be most affected by the change not people who use these. The new rule which took effect. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions.

The previous threshold was 20000 and 200 transactions. Except for commercial transactions expressly authorized by Venmo for example transactions with authorized merchants or. Ive received 1099-Ks previously when I had less than 20000 or fewer than 200 transactions.

Any income you earn through a peer-to-peer cash app is taxable but you may be able to. The act modifies the IRS reporting requirement for payments on apps from the previous threshold of 20000 down to 600 and will go into effect Jan. You would receive two separate 1099-K forms one from each platform reporting your annual transaction amount.

Who will be affected. For the 2022 tax yearthe tax return that youll file in 2023third-party payment networks such as PayPal and Venmo will be responsible for reporting under the new threshold. Who will be affected.

The change is a new reporting rule not a new tax meaning you wont be taxed on all of your Venmo transactions when you file your 2022 taxes says Lisa Greene-Lewis a certified public accountant and tax expert at TurboTax. In this file photo the Venmo app on a mobile phone arranged in Dobbs Ferry New York US on Saturday Feb. But really the new law is a reporting change not a tax increase.

The new rule which took effect. The new rule which took effect.

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Venmo Tax Reporting For Personal Use Does Venmo Report To Irs

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Press Release New U S Tax Reporting Requirements Your Questions Answered

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Venmo Tax Reporting For Personal Use Does Venmo Report To Irs